Introduction

The original set o rules came from a book by John R. Hill.

They were reoffered by another vendor and sell for $100.

Long entry rules

Pivot Point Low: Lowest point in a movement prior to penetration of a daily high. Close must be above previous close on day of penetration of that high.

After pivot point, wait for penetration of that low. Go long on the close of day that:

1. Closes above two previous closes.

2. Close is above the pivot point low.

3. Close is above opening price and above the midrange of the day action.

4. This day range is greater than the previous day's range.

5. This reversal day occurs no later than six days after penetration of pivot point low.

Short Entry Rules

Exact opposite of the above. In other words, look for penetration of pivot point high and then reversal down.

Initial Stop on Long:

One tick below the extreme low after entry.

Initial Stop on Short:

One tick above extreme high after entry.

Trailing Stop:

Always move stop up to next pivot point low.

Exit Rules on Buys:(Exit Rules for Shorts are Opposite)

1. Only on execution of stop or on a sell signal.

2. After a $1000 profit or rule 1.

3. Four days after entry or rule 1.

4. Move stop to a point of entry if position is at a profit after four days and then exit via rule 1.

Sunday, September 15, 2013

Tuesday, September 10, 2013

How to diversificate properly your portfolio?

Just follow this set of rules:

1. You cannot purchase a stock that will increase a position more than 25% of your portfolio (always).

2. No one stock can exceed 25% of your portfolio assets (Majority of quarter).

3. Half of your portfolio must be made up of stocks of 10%(or less) of your portfolio assets (Majority of quarter).

And that's it!

Monday, September 09, 2013

Next cycle up?

Next cycle up? by steveoliveira on TradingView.com

Complex normally is followed by a contrarian movement.

What everyone looks for in the stock market?

Everyone

have dreams, and the majority has a crappy job or a lot of debt and Mr. Market

is there and offers you the light at the end of the tunnel. Most people can

achieve a good return on investment if pointed on the right direction, however

if a good return is something around 10 to 15% a year, then we have a problem.

How can I solve

my problems with a 15% per year on 10.000 USD of investment? 1500 USD?

So the

solution is to try to keep looking for some kind of strategy that yields you something

big. Because you know that is possible to achieve such a return. You saw Tim

Sykes, and the guy can do it, and teaches you how to get there, so can you replicate

him? I don't know that answer, I just know that for the majority of you are

going to loose time and money in the process.

The idea

that you can yield a big return from a little account that can change your life

and put you trading for a living from any part of the world seems compelling.

My advice…

Take a look

at Millionaire Traders from Kathy Lien. It’s an interesting book… See if you

identify yourself with any of the traders and good luck with the process.

Thursday, September 05, 2013

Harmonics

Now harmonics are the new trend in technical analysis. I haven´t seen this subject in my CMT exams, but i guess it will be there soon.

The big question is to know if it works, and the answer is yes and no.

We have a tendency to memorize the charts that worked and seem to forget the ones that didn't, in the end it's all a matter of money management for the people who put the trades.

There will be the whipsaws or the noise to make your life harder, it's a part of the process as in all other patterns.

In the meantime, let's enjoy.

Thanks,

S.

Some upside here... by steveoliveira on TradingView.com

The big question is to know if it works, and the answer is yes and no.

We have a tendency to memorize the charts that worked and seem to forget the ones that didn't, in the end it's all a matter of money management for the people who put the trades.

There will be the whipsaws or the noise to make your life harder, it's a part of the process as in all other patterns.

In the meantime, let's enjoy.

Thanks,

S.

Some upside here... by steveoliveira on TradingView.com

Wednesday, September 04, 2013

Anatomy of a Position Trade

I want to share you how i approach a trade setup on the SPY.

First thing to do is to perform a technical analysis and identify the red zones and potential movements.

It's clear that there is a strong support around 160, which if breached will end the bull scenario, however we also have a good positive divergence on the last swing lows which are also present in some of the index components.

We have a gap at 168 that can be used as target.

So, if i wanted to play the long side, i would Buy 100 shares at 164.39 and sell a Covered Call at 168 for 0.54 cents and collect some premium.

I would also Buy 2 163 Puts and Sell 4 160 Puts for 0.98 cents, making a ratio spread.

This means that if the stock falls to 159 (at expiration), below support i will be assigned on the 2 Puts that are naked, making me long on 200 shares @ 160. However my average on this 200 shares will fell to 157 because of the profit on the long puts.

In the end i will have a position of 300 shares with an average price of 159.46 plus the premiums received on the covered calls and the ratio.

If the stock rises to 168 at expiration, i will assign and keep the profit and premiums.

Note: Options are risky and you should read Characteristics and Risks of Standardized Options and Supplements

Tuesday, September 03, 2013

When to Sell?

One

question a i get a lot is when to exit the trade. Because if you study a little

bit, you will find that it is easy to get it right when to buy, the problem

comes later when it’s time to sell.

Mr. Market

knows how to get your mind mixed up and that’s why there is this complex

movements that make you exit at the lows and enter at the highs.

That’s why I

think you need to have some sort of strategy to help you exit without making

you think a lot.

One way to

this is to plot a moving average of the lows. In the following chart you have a

3 day MA of the lows, and you can see that it helps you with the trend.

You can

tweak the indicator to get a more accurate setting of the stock in play.

However,

remember that this kind of strategy is best as a trailing stop, and that’s

because when you enter is also when there’s more volatility and the only way to

overcome the noise is to have a fixed initial stop that is in line with your

risk parameters. As the price enters in trend mode, you place your trailing strategy.

Thanks,

S.

Thanks,

S.

Monday, September 02, 2013

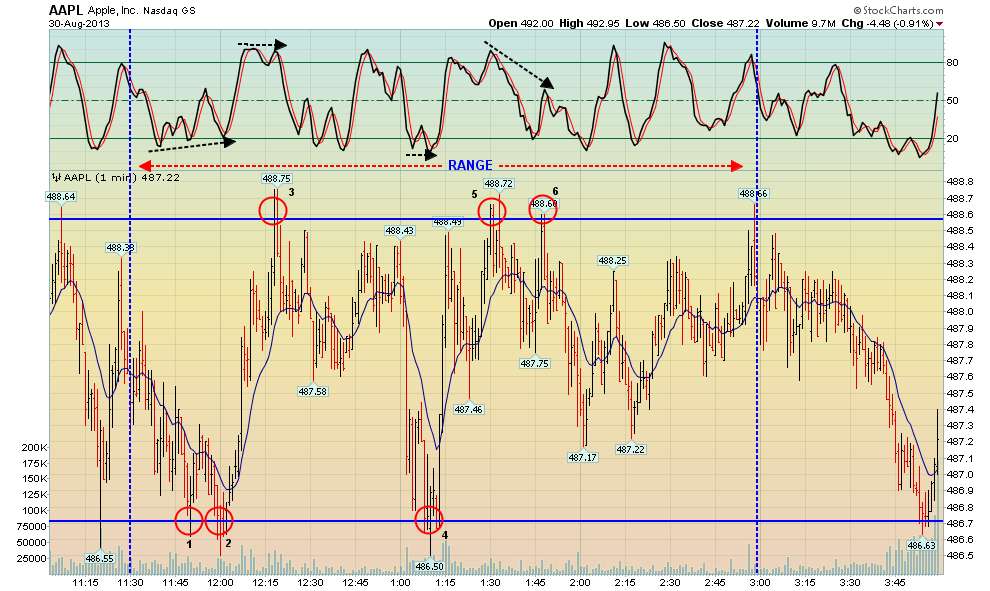

The importance of time during the day to daytrade

Normally i see some directional movement until 11h30 and then after 3PM.

In the between hours, normally there are very good opportunities to fade highs and lows.

Use an oscillator to help and a stock that had a recent strong daily thrust bar.

Here is an example:

Level 2 quotes will help improving the odds of a successful entry.

Thanks,

S.

Sunday, September 01, 2013

Wedge or Ending Diagonal

If you like patterns, my advice is to look for them in higher time frames.

I found this beautiful wedge 5 months ago. It was a good trade and i want to share it with you.

Original Post:

This one shows a good ROIC (return on invested capital) which means that fundamentals support the long side, however this sector is one of the hated, but still, i see some accumulation building.

I will wait for the wegde breakout to get long, and i'll wait until the 38.2% retracement, that's a 60% upside.

I like this one a lot!

Capella Education Company by steveoliveira on TradingView.com

Friday, August 30, 2013

Trading System Rules

Do you have what it takes to follow the rules of a system? Most people can't.

Example:

1. Stock above the 200 Day Moving Average;

2. RSI (4 Period) close below 20. Buy 1/2 on close;

3. Buy a second half if RSI closes below 15;

4. Exit when RSI closes above 60;

What do you think?

I will show next how to improve the exit.

Thanks,

S.

Example:

1. Stock above the 200 Day Moving Average;

2. RSI (4 Period) close below 20. Buy 1/2 on close;

3. Buy a second half if RSI closes below 15;

4. Exit when RSI closes above 60;

What do you think?

I will show next how to improve the exit.

Thanks,

S.

Gold retracement

Gold retracement by steveoliveira on TradingView.com

We are near the completion of an ABCD pattern. Following the harmonic

rules, a C point retracement leaves up with a 200%BC projection

I think we could see some downside, which is confirmed by a hidden price divergence (not on the chart).

Please take notice, that there were very strong sell offs and we are still in the bears zone.

Thanks,

S.

Thursday, August 29, 2013

Climax Selling

Climax selling... by steveoliveira on TradingView.com

This is a perfect example of a parabolic movement, which normally ends with a 61.8% retracement.

Volume was there for confirmation.

Wednesday, August 28, 2013

What about credit spreads?

So many

write about credit spreads, but what about them? Are they reliable, are they

risky, are they adjustable? Can I trade it on the weekly options? All this

questions seems to arise when someone puts some kind of effort to try this

strategy.

I’ve been

doing this for a while and I must say that the first problem you face when you

start trading credit spreads, is the risk you take. Normally you start looking

to high price stocks like Apple and start with out of the money options.

So let’s

suppose you want to place a trade in Apple very far away from the current price.

Assuming a 10K account.

You pick

430-420 (21 September):

Theoretically you get 45 USD (112-67) for every 1000 risked. If you place an order for 10 options contracts, you are gaining 450 USD for the 10.000 USD at risk. That's 4.5%! You just need that Apple stays above 430 to cash in the premium. If you do this every month then that's 54%!!!!

This is what everyone is selling in the webinars.

But what if the stocks falls to 440 in the next 10 days...

430 strike will start trading at 5 and 420 will trade at 2.5, which means that you're down around 2000 USD.

And if in the process Apple shows some kind of problem and the stock falls to 420? The 430 will start trading at 14.7 and 420 at 9, that sums around 5000 USD loss, which if we are speaking of a 10K account, that will be gameover for you.

So the question is: Does it make sense to risk so much for such a return?

No it doesn't...

So what's the problem?

The problem is called leverage! You are trading a possible exposure of 430.000 USD with a 10K account. Eventually it will end bad... It's a question of time.

The right mindset for a credit spread it the same for a naked put, which means you are willing to buy the stock if you get there. That's it! Don't expect the 4.5% steady income month after month.

Like a covered call strategy, you don't buy 100 shares and sell 10x more call options. You trade 1 option for each 100 shares.

Remember, leverage is the fastest way to blow up an account. Then again, many are doing it and are successful and that is the reason that in the end you will ignore everything i just wrote.

Good investing,

S.

Italy can retrace?

Italy can retrace? by steveoliveira on TradingView.com

We have here a retest of the resistance zone while showing a very bearish combination of candles.

I expect to see some downside in the next days, probably testing the 16600 zone which was a previous rotation area. It could develop in an ABC format.

I expect to see some downside in the next days, probably testing the 16600 zone which was a previous rotation area. It could develop in an ABC format.

Bearish Gartley

I still think the odds favor the upside break, however we must not ignore the price action and right now we are testing resistance in confluence with a bearish Gartley.

I'll be looking for confirmation and watching it closely.

Tks,

S.

Big Range...

Big Range... by steveoliveira on TradingView.com

We are trading at resistance (1.3450/1.3415) and if we clear it, we could go to 1.37. This would be the next stop. However looking at a 12 month Market Profile Chart, we see that right now we are trading at Value Area High and this is important because if we fail to breach it, then the next stop will be the point of control at 1.3050.We can see also that divergences are present and oscillators are overbought, which means that we need to have a lot of strength to get through the current resistance zone.

Safest thing right now if to go down to lower time frames to figure what the tape is telling us.

Trade well...

S.

Tuesday, August 27, 2013

SPX - MY BEARISH CASE

SPX - MY BEARISH CASE by steveoliveira on TradingView.com

We have two rotation zones or box of prices as you wish to call it. What i think it is important, is that we have two distinct moves that end very similar at the top of each rotation box. So we could have some downside with a very strong support at 1549, which is my Point of Control for the last 6 months (market profile chart), and then if Mr. Market wants, we could head down to the bottom of the box.

The movement until 1549 will be an ABC on the current Elliott Wave Count, and i think it has a good probability to happen. The movement from 1549 to 1400 is a low probability and we have to check the chart again after 1549 is tested. If 1549 is breached, there will be a projection that will take place and that's where i'm basing my analysis on the downside target.

One other important detail is that the gap at 1700 is still there to be filled.

Monday, August 26, 2013

Setup

Trading Setup (Example) - Harami by steveoliveira on TradingView.com

A good trading setup have to show us a confluence of signals, so in this example we have:

61.8% Retracement;

Good Hidden Divergence;

Oversold;

And an inside bar pattern.

The Inside Bar Pattern is traded by entering in the breakout direction. It is best to name it harami, as we are looking to a candle chart.

In this example i would say, that the entry point would be 15.000, with a stop around 14.879. The target will be set around 15.250, corresponding to the mid point of the selling bar. which leaves us with 2/1 return ratio.

Subscribe to:

Posts (Atom)